How to innovate in seafood processing industries?

“Tradition is no longer what it used to be!” – the expression could be said by any elderly Portuguese about gastronomy, his town, or the company he worked for or saw in operation in his time.

Truth is that this finding can and should be a positive factor. Let’s see why and what are the guidelines for innovation in the sector.

Innovation in the seafood processing sector could have been influenced by the rise of technology, the increased shelf-life of food products or the decline in fishing resources combined with the fall in fishing quotas. Dare to innovate in such a traditional sector is the great challenge for Portuguese companies to increase their competitiveness in the international panorama and to promote better production rates with higher quality and more diversified products.

Data don’t lie

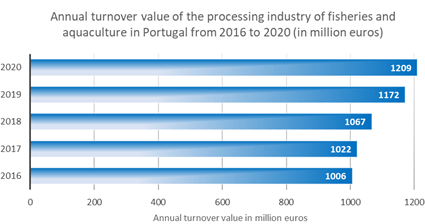

In recent years, the number of companies in the sector has been decreasing (from 203 in 2008 to 150 in 2020). This is mainly due to the closure of Portuguese canneries (which reached 400 in 1925[1]), mergers between companies or their acquisition by larger economic groups. According to the latest data from INE (Portuguese Institute of Statistics), the processing industry of fisheries and aquaculture has increased its production and turnover, despite being less and less.

In 2020, this industry reached a total production of 239 thousand tons (compared to 233 thousand tons in 2019) and earned more than 1209 million euros in 2020, an increase of 3.1% compared to the previous year’s results. The epidemiological situation of COVID-19 experienced in 2020, exacerbated this situation (periods of confinement, etc.) and will have favoured the increase in consumer demand for canned fish by consumers, and even an increase of 22.5% in this segment[2].

Why innovate and use technology?

The bottleneck of the sector is to keep tradition alive while reinventing itself, creating more and more differentiated, innovative and value-added products, combining the flavours of the past with the trends and preferences of consumers. In fact, for today’s consumers, it is not enough to preserve the taste and nostalgia of the past, they are also attracted by: the packaging aspect; combination of flavours; transparency and nutritional quality; convenience of having a ready-to-eat or ready-to-cook meal; low level of processing; use of natural and organic ingredients and without chemicals; local or national products; animal welfare and social, economic and environmental sustainability concerns; and premium status that its consumption confers on the consumer.

On one hand, in a traditional sector where labour is scarce, the revolution and modernisation of technological systems are crucial, embracing Industry 4.0, where data processing, sensorisation and real-time monitoring are the ingredients for fast and accurate decision-making, resulting in improved quality, increased productive capacity and increased revenues. In this scenario, technology is particularly useful in processes such as filleting, gutting, or precision cutting; rapid identification and disposal of fish with bone deformities, insufficient caliber or presence of parasites/pathogenic micro-organisms; systems and chains for reuse and valorisation of by-products currently only valued for animal feed; more sustainable packaging solutions with less plastic; quality monitoring solutions; blockchain technology with traceability of origin¸ and extension of shelf life.

On the other hand, the Portuguese fish processing industry must look to other industries, including non-food industries, and venture to innovate in management, studying and applying intelligent management methodologies, which include not only methodologies for improving production parameters (e.g. Lean, Kanban, Kaizen, Six Sigma,, but also the adoption of agile systems for product and project development, which improve the speed and quality of products developed by work teams (e.g. Scrum or Stage-Gate methodologies).

The paradigm shift also involves adopting the concept of “open innovation”, where companies break the taboo of opening their doors to people outside the organisation, such as public authorities, consultants, universities, chefs or companies in the same or different sectors. The aim is to work together, to involve all the players and stakeholders, to capture external and differentiated knowledge, and to reduce the risk of failing to creation of new value-added products with the capacity for internationalisation. In fact, strengthening collaboration allows companies to take advantage of opportunities to reduce costs and increase their visibility at national and international trade fairs. The integration of these elements in the different stages of product or process development – from brainstorming and ideation sessions to prototyping and market launch – is essential for product success.

European incentives

Finally, the European Union is increasingly demanding this type of collaboration. Consortia in public funding for research and development are becoming more frequent and involving more players. Public support for innovation is also one of the driving forces for companies to achieve their growth targets. Companies should be aware of the deadlines for submitting applications for new operational programmes which, in the next decade, may mobilise the most interesting funds ever: the Recovery and Resilience Plan (which has already started) has an allocation of 16.6 billion euros, Portugal 2030 has an allocation of 33.6 billion euros and there is still the remaining fund from Portugal 2020. From these or other mechanisms, there will be MAR 2030, EEA grants, or regional programmes (NORTE 2030, CENTRO 2030, among others), as well as ongoing programmes such as Horizon Europe or the European Innovation Council. There is also the SIFIDE incentive, which allows companies to deduct up to 82.5% of the costs of carrying out research and development activities in the reference year.

How to take up a position?

Briefly, the coming years present a great opportunity for seafood processing companies to innovate and invest to grow their business. If you are running one of these businesses, then this is definitely something that you need to keep an eye on and you can count on B2E as your partner, namely through our Funding Watch service. Contact us to find out more.